Out With 2023, In With a New High for the S&P 500

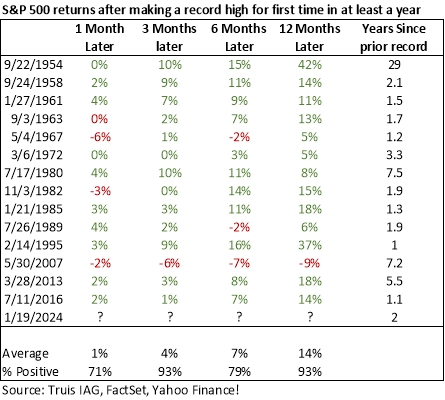

A new record! It took just over two years, but on January 19, 2024, the S&P 500 reached a new high. Truist Bank analyzed the performance of the S&P 500 after each instance in which it set a record high for the first time in at least a year. There have been 14 such instances and all except one (2007) resulted in positive returns a year later. The market can go through long periods without making new highs for a variety of reasons, but they primarily relate to recessionary or near-recessionary conditions.

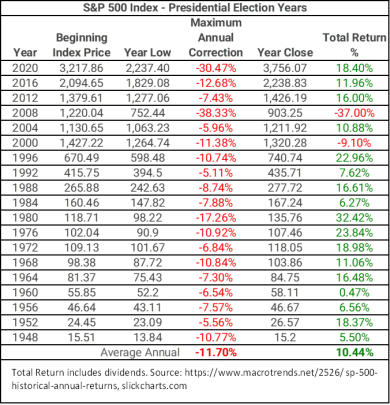

The presidential election cycle has officially begun with the first few primaries in the rearview mirror. There have been 18 presidential elections since the end of World War II. The only election years where the S&P 500 had a negative return were 2000 from the Dot-Com Bubble and the 2008 Financial Crisis (coinciding with the lone negative return in the first study).

While past performance doesn’t guarantee future results, history does have patterns and often repeats. These two separate unrelated studies provide a nice investing backdrop for the year ahead. It may be bumpy along the way, as it often does, but the future may be bright.

DISCLOSURE

Innovative Portfolios, LLC (“IP”) is an SEC-registered investment advisor founded in 2015. Clients or prospective clients are directed to IP’s Form ADV Part 2A prior to deciding to participate in any portfolio or making any investment decision. The views and opinions in the preceding publications are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in any commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, and is not intended to predict or depict performance of any investment. Any specific recommendations or comparisons that are made as to particular securities or strategies are for illustrative purposes only and are not meant as investment advice for any viewer. The companies mentioned in the publications may be held by Sheaff Brock Investment Advisors, Innovative Portfolios, Innovative Portfolios’ ETFs or any other affiliates or related persons. Therefore, there is a conflict of interest that the advisors may have a vested interest in the Companies and the statements made about them. Past performance does not guarantee or indicate future results.