All Eyes on the S&P 500 Index

Now that is a way to start the year off! In January 2024, the S&P 500 reached a new record high for the first time in two years. As of February 15, the S&P 500 Index has set new record highs 11 times and risen 5.45% since year-end. Not the best start ever, but still solid. Much has been said about the impact the top of the market (the so-called Magnificent 7) has had on returns of the S&P 500 over the last year.

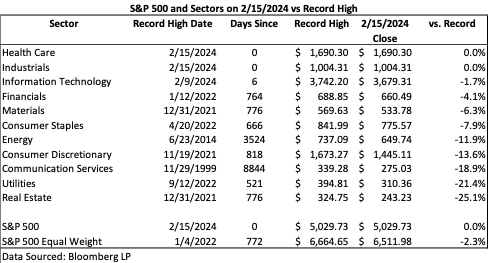

While the market rally has broadened over the last few months, the S&P 500 Equal Weight Index is still 2.3% below its record. Additionally, only three out of the eleven sectors (Health Care, Industrials, and Information Technology) have set new records this year. The other eight sectors still have work to do. On average, these eight sectors are 13.7% below their respective records.

The market constantly has an evolving set of sector leaders; Tech and Industrials have been the best-performing sectors for a while with Healthcare recently making bigger moves to join them as the market leaders. The current S&P 500 Index rally may still have more legs if the average stock (as represented by the Equal Weight S&P 500 Index) continues to approach its respective records. Given the broadening market rally and potential for a soft landing, this seems like a reasonable potential without material outlook changes.

DISCLOSURE

Innovative Portfolios, LLC (“IP”) is an SEC-registered investment advisor founded in 2015. Clients or prospective clients are directed to IP’s Form ADV Part 2A prior to deciding to participate in any portfolio or making any investment decision. The views and opinions in the preceding publications are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in any commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, and is not intended to predict or depict performance of any investment. Any specific recommendations or comparisons that are made as to particular securities or strategies are for illustrative purposes only and are not meant as investment advice for any viewer. The companies mentioned in the publications may be held by Sheaff Brock Investment Advisors, Innovative Portfolios, Innovative Portfolios’ ETFs or any other affiliates or related persons. Therefore, there is a conflict of interest that the advisors may have a vested interest in the Companies and the statements made about them. Past performance does not guarantee or indicate future results.