Post-Election, Here’s How Americans Are Feeling About the Market

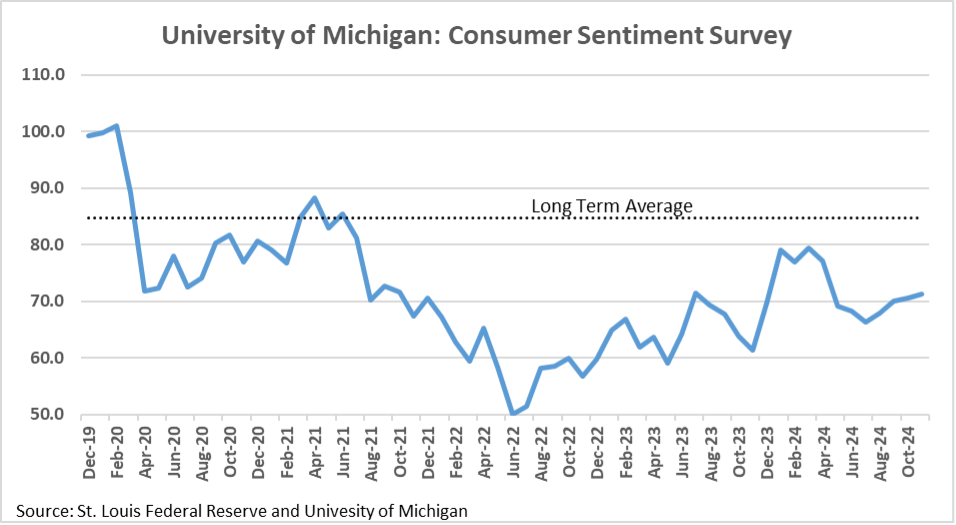

The election is over, and people’s attention can shift back to daily life and the upcoming holidays. But how are Americans feeling across different segments of society? The University of Michigan has been conducting a Consumer Sentiment Survey monthly since 1978. This survey captures views on current and future economic conditions. While inflation has slowed materially, its sustained impact on prices continues to weigh on consumer sentiment despite the economy’s ongoing resilient growth. The most recent reading for November 2024 was 71.3, a rebound from the all-time low of 50 recorded in June 2022, when inflation peaked at 9.1%. While consumers are feeling better now, their sentiment remains well below pre-COVID levels and the long-term average of 84.7.

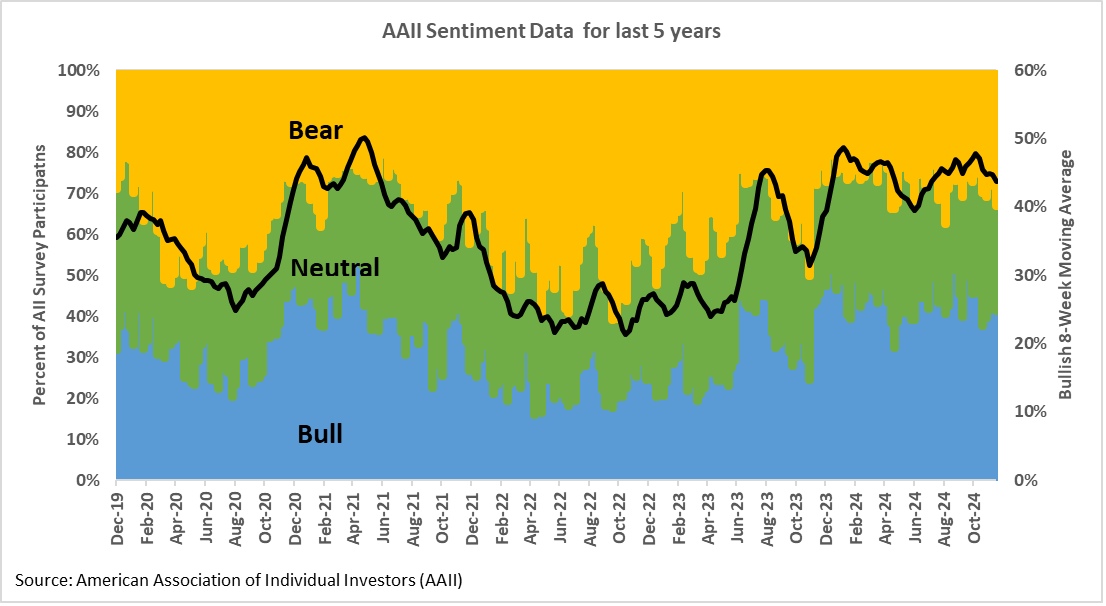

In contrast to consumers’ lukewarm outlook, investors appear to be more optimistic. The American Association of Individual Investors (AAII) has been polling its readers weekly since July 1987, asking whether they are bullish, neutral, or bearish. While the weekly results can fluctuate, the rolling eight-week moving average provides a smoother view of trends. As of November 21, 2024, the rolling average for bullish sentiment stands at 43.7%, above both pre-COVID levels and the long-term average of 37.7%. With the market hitting a record high of 50x in 2024 (as of November 25, 2024), it’s easy to see why investors are feeling confident.

Investing is often discussed in terms of numbers—returns, growth, earnings, and dividends. While these are critical metrics, sentiment is also important in shaping market behavior. Investing is heavily influenced by emotion, whether it’s exuberance during bull markets or fear during downturns. Understanding how people feel about the economy is essential for grasping its trajectory. The effects of inflation continue to be a challenge, and grocery bills remain high, but the U.S. economy has shown remarkable resilience. As the holidays approach, there is plenty to be festive about, and 2025 hopefully will continue to bring new opportunities.

DISCLOSURE

Innovative Portfolios, LLC (“IP”) is an SEC-registered investment advisor founded in 2015. Clients or prospective clients are directed to IP’s Form ADV Part 2A prior to deciding to participate in any portfolio or making any investment decision. The views and opinions in the preceding publications are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in any commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, and is not intended to predict or depict performance of any investment. Any specific recommendations or comparisons that are made as to particular securities or strategies are for illustrative purposes only and are not meant as investment advice for any viewer. The companies mentioned in the publications may be held by Sheaff Brock Investment Advisors, Innovative Portfolios, Innovative Portfolios’ ETFs or any other affiliates or related persons. Therefore, there is a conflict of interest that the advisors may have a vested interest in the Companies and the statements made about them. Past performance does not guarantee or indicate future results.