About Our Two Cents

Innovative Portfolios is a highly experienced institutional money management firm offering actively managed portfolio strategies to financial professionals, RIAs, consultants, and institutional investors. Our goal is to deliver outperformance in income and/or growth for investors seeking higher yield.

Our Two Cents is the forum where we share our thoughts on everything from money and the markets to interest rates, the economy, the Federal debt, historical trends and much more.

Featured Investment Managers

Is the Economy’s “Soft Landing” Finally Here?

Economic conditions and data points continue to evolve, sending mixed signals. While growth appears to be slowing, the Federal...

REITs May Be Lovable Again

The real estate sector is starting to turn the corner after being unloved for the last few years. The...

AI’s Effect on the S&P 500

Jubilant emotions related to the Artificial Intelligence (AI) revolution are likely clouding investors' perceptions. Investors can’t seem to get...

With Q1 Earnings Season at an End, What’s Next?

Equities continue to look pretty appealing as the Q1 earnings season is wrapping up. The cumulative effects of inflation...

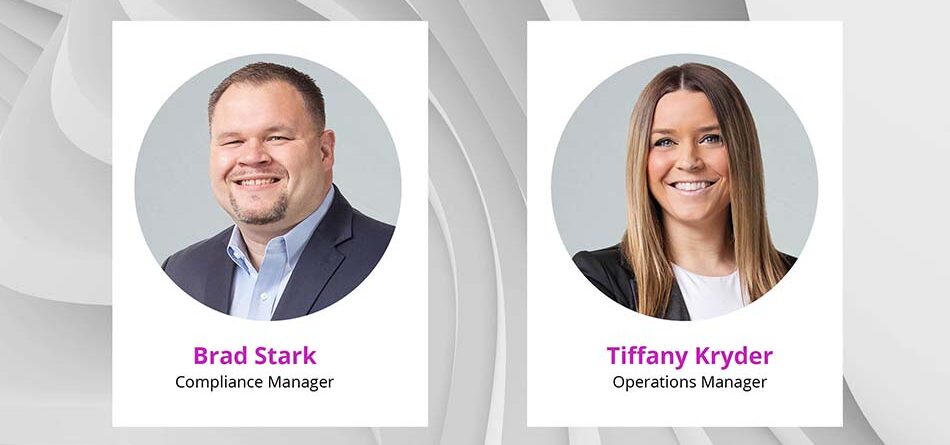

Two New Faces at Innovative Portfolios

"Making sure everything is safe, secure, and suitable for both individual and institutional clients," is the way Brad Stark,...

DISCLAIMER

Innovative Portfolios, LLC (“IP”) is an SEC-registered investment advisor founded in 2015. Clients or prospective clients are directed to IP’s Form ADV Part 2A prior to deciding to participate in any portfolio or making any investment decision. The views and opinions in the preceding publications are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in any commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, and is not intended to predict or depict performance of any investment. Any specific recommendations or comparisons that are made as to particular securities or strategies are for illustrative purposes only and are not meant as investment advice for any viewer. The companies mentioned in the publications may be held by Sheaff Brock Investment Advisors, Innovative Portfolios, Innovative Portfolios’ ETFs or any other affiliates or related persons. Therefore, there is a conflict of interest that the advisors may have a vested interest in the Companies and the statements made about them. Past performance does not guarantee or indicate future results.