Important Notice

You are now leaving the Innovative Portfolios ETFs site and being directed to the Innovative Portfolios Advisor site.

The Fund’s primary investment objective is to seek current income.

The Fund invests in preferred equities and an S&P 500 index-based option overlay for additional income.

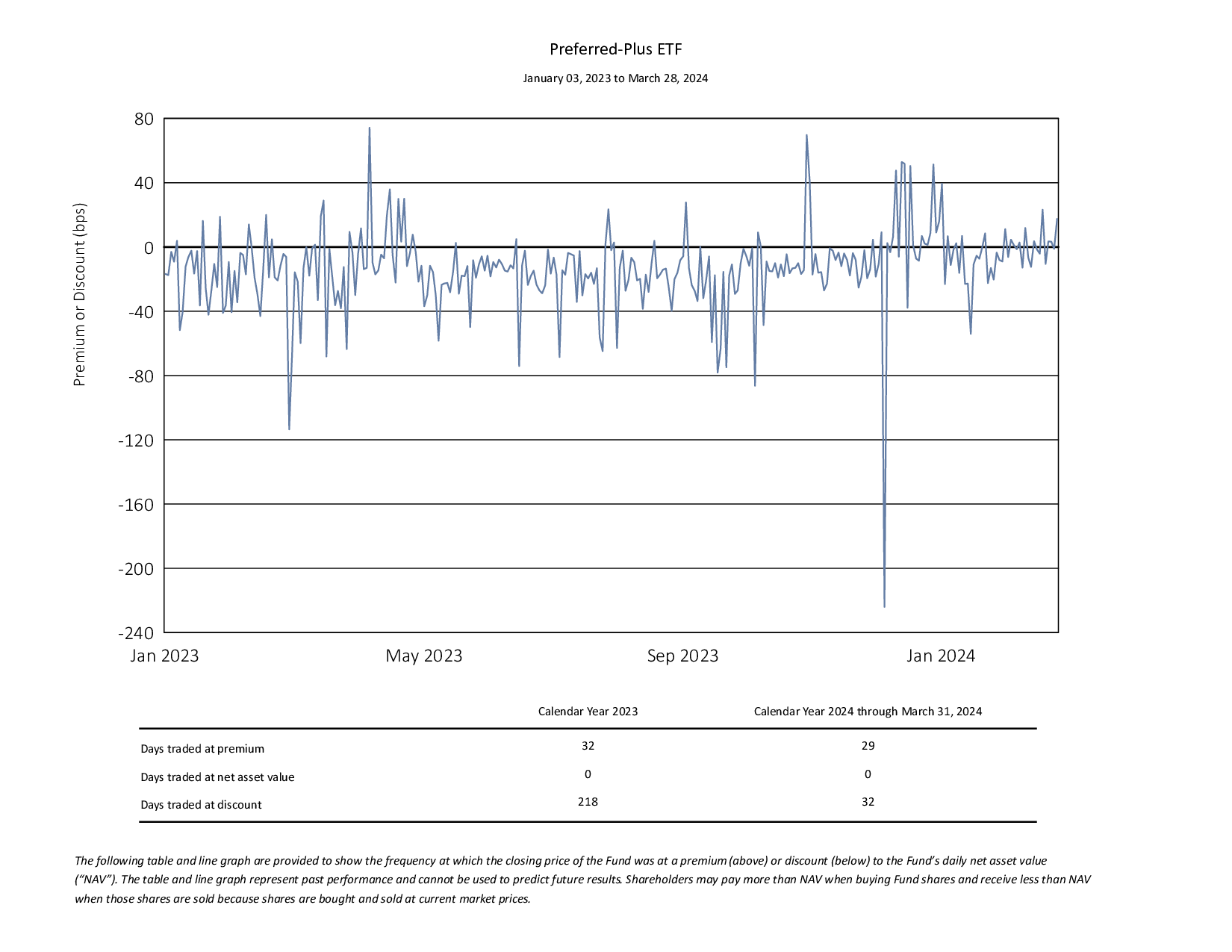

| PREMIUM DISCOUNT HISTORY Data as of 07-01-2025 |

||||||||

|---|---|---|---|---|---|---|---|---|

| ||||||||

Prior to listing date, the ETF operated as a mutual fund and therefore premium/discount information is not available from inception to listing.