April’s Stock Market Corrections Brought a Breather

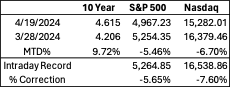

Stock Market corrections are a healthy part of investing – they give everyone a chance to lock in some gains and take a breath. From October 31, 2023, through the end of March 2024, the S&P 500 rose steadily and returned a whopping 25.3%. April 2024 has brought a bit of a correction, however: S&P 500 declined as much 5.5% in the month, and the NASDAQ had declined slightly more through April 19, 2024. The market recovered some of that over the last few days.

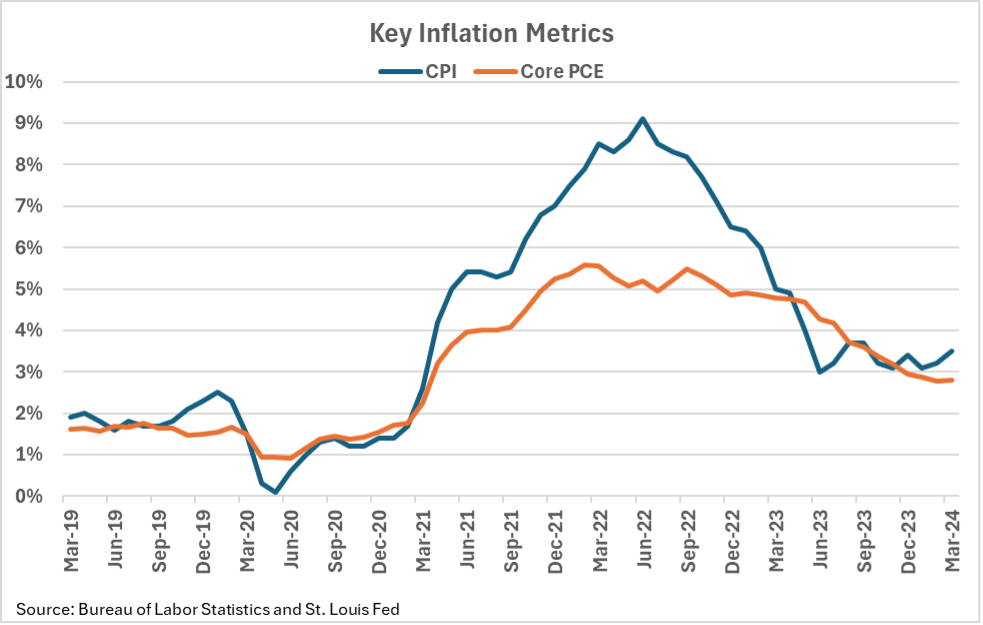

The declines have a couple of little contributors and one large one. There have been five consecutive months of strong returns, so it’s not surprising behavior to have a pause. Also, some investors may be liquidating to pay taxes. The primary culprit for the market behavior has been the sticky inflation rates. The Consumer-Price-Index (CPI) has been declining since June 2022, but recent reports have been higher than anticipated. The primary contributors to the CPI have been the cost of housing and transportation (such as insurance and airline prices). Similarly, the Federal Reserve’s (Fed) primary metric, the Core Personal Consumption Expenditure (PCE), has been a little higher lately. While inflation has slowed materially, the ‘last mile’ seems to be difficult. Meanwhile, the overall economy continues to be strong with GDP in Q1 2023 at 1.6% and Q4 2024 at 3.4%.

With the still-strong economy and inflation levels, investors are again changing their interest rate expectations. At the start of the year, the market was predicting the Fed to lower rates up to six times (of 0.25%), now it is only one or two. Before cuts were on the horizon, now they are back to higher for longer; some are fearing rates will be increased instead. This action has caused an increase in the 10-Year Treasury interest rates, prompting investors to sell stocks off. The Fed will likely be slow to cut, but a few key indicators are still implying the downward trajectory of inflation, namely slowing job applications and wages, declining business inflation expectations, and limited rent growth.

The US economy has continued to be very resilient and adaptive. Inflation is trending downward, even if the rate is not as fast as hoped. As a result, the recent rise in the 10-year Treasury and decline in stocks are likely only temporary fears.

DISCLOSURE

Innovative Portfolios, LLC (“IP”) is an SEC-registered investment advisor founded in 2015. Clients or prospective clients are directed to IP’s Form ADV Part 2A prior to deciding to participate in any portfolio or making any investment decision. The views and opinions in the preceding publications are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in any commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, and is not intended to predict or depict performance of any investment. Any specific recommendations or comparisons that are made as to particular securities or strategies are for illustrative purposes only and are not meant as investment advice for any viewer. The companies mentioned in the publications may be held by Sheaff Brock Investment Advisors, Innovative Portfolios, Innovative Portfolios’ ETFs or any other affiliates or related persons. Therefore, there is a conflict of interest that the advisors may have a vested interest in the Companies and the statements made about them. Past performance does not guarantee or indicate future results.