What’s Been Expected (and Not) in the Current Market

The policy uncertainty stemming from the Trump Administration has triggered a wave of emotions and concerns across both social and economic sectors. According to survey data, uncertainty levels are now even higher than during the COVID-19 pandemic—a surprising reality. While evolving tariff policies and their potential ramifications have contributed to this environment, the rapid shift in investor sentiment has been striking. After reaching near-record highs following the election, sentiment has plunged to near-record lows within just a few months, leading to a broad market sell-off. Given the market’s strength over the past two years and the transition to a new administration, increased volatility was expected.

In addition to policy uncertainty, recent economic data have also made investors uneasy. It’s essential to consider the broader picture; a slowdown in economic growth was widely anticipated (following years of rapid expansion), and employment levels remain relatively balanced. Inflation does, however, remain sticky, posing an ongoing challenge.

On March 19, the Federal Reserve opted to keep the overnight interest rate unchanged. They also provided updated economic projections through their well-known “dot plots.” Their 2025 Real GDP growth forecast was revised downward from 2.1% to 1.7%, slightly below the long-term projection of 1.8%. Unemployment expectations edged up to 4.4% from 4.3%, while the long-term estimate remained at 4.2%. Inflation expectations for 2025 also increased, possibly due to tariff effects, though the Fed still anticipates inflation will approach its target by 2026.

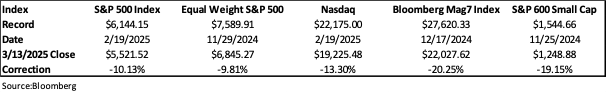

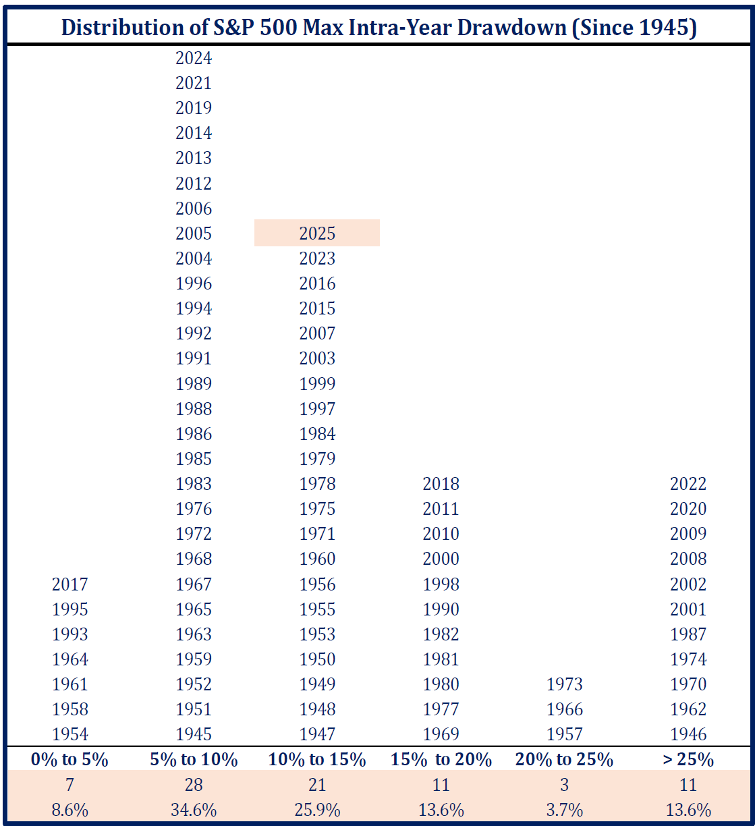

The combination of policy uncertainty and slower growth has fueled investor anxiety and market volatility. On March 13, the S&P 500 officially entered correction territory, falling 10.1% from its record high. Other major indexes have experienced similar declines. Since then, the market has recovered some of its losses, but only time will tell if the downturn has run its course. It’s important to remember that market corrections are a normal and healthy part of investing. Since 1945, intra-year declines of 10–15% have occurred in approximately 26% of years. These periods, while challenging, often present long-term opportunities for disciplined investors.

Source: Strategas

DISCLOSURE

Innovative Portfolios, LLC (“IP”) is an SEC-registered investment advisor founded in 2015. Clients or prospective clients are directed to IP’s Form ADV Part 2A prior to deciding to participate in any portfolio or making any investment decision. The views and opinions in the preceding publications are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in any commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, and is not intended to predict or depict performance of any investment. Any specific recommendations or comparisons that are made as to particular securities or strategies are for illustrative purposes only and are not meant as investment advice for any viewer. The companies mentioned in the publications may be held by Sheaff Brock Investment Advisors, Innovative Portfolios, Innovative Portfolios’ ETFs or any other affiliates or related persons. Therefore, there is a conflict of interest that the advisors may have a vested interest in the Companies and the statements made about them. Past performance does not guarantee or indicate future results.