Is the Stock Market Currently Overvalued?

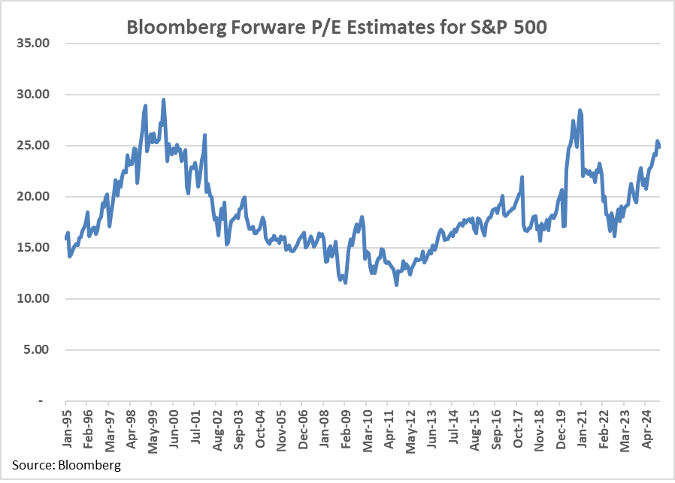

A significant number of pundits and analysts are currently calling the stock market overvalued, citing earnings multiples that are elevated compared to historical levels. According to the Bloomberg Estimates Price/Earnings Ratio (Best P/E Ratio) for the S&P 500 Index, the forward P/E stood at 24.9x as of year-end. This figure is indeed at the higher end of historical ranges, above long-term averages and pre-COVID levels. However, viewing the market solely through this lens could be missing a bigger picture. The strength of mega-cap stocks has significantly skewed the current valuation levels. The index is more concentrated than ever before, and these dominant companies are trading at multiples well above the broader index.

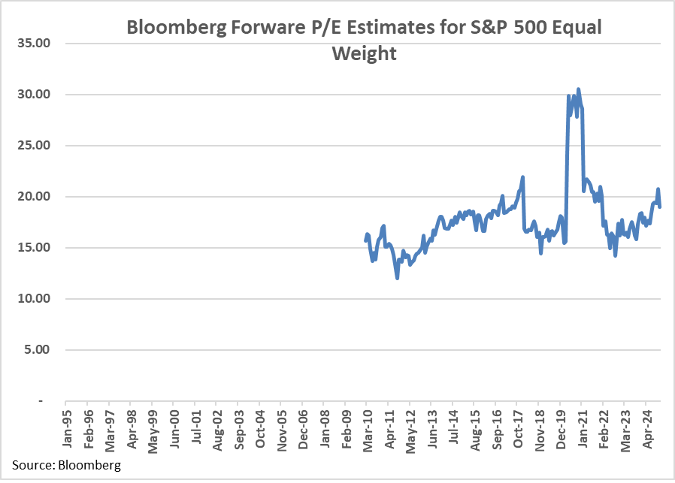

When examining valuations from a different perspective, the picture changes. For instance, the S&P Equal Weight Index finished 2024 with a forward multiple of 19.0x, according to Bloomberg Estimates. This level is slightly above its historical average (since 2010) of 17.7x and close to the pre-COVID multiple of 18.1x (December 2019). By this measure, the current levels are not excessively high.

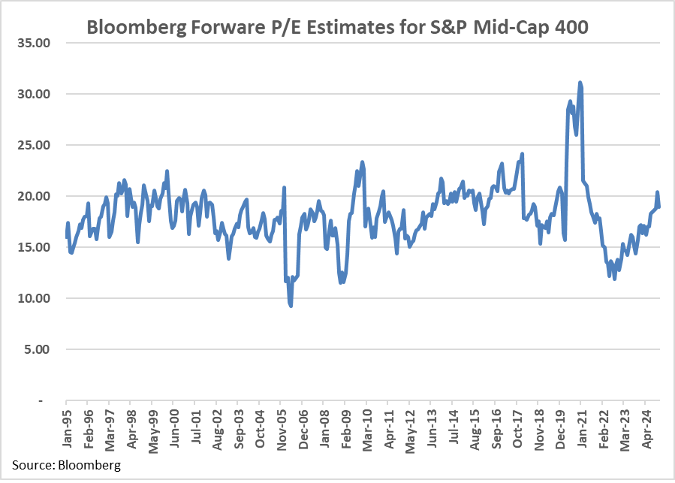

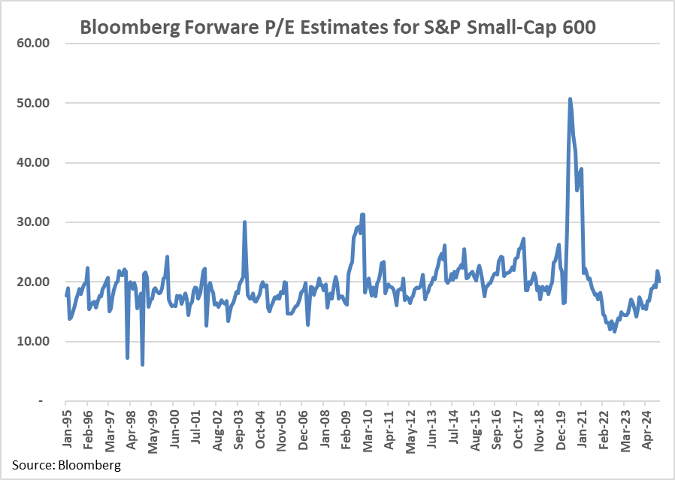

The S&P Mid-Cap 400 Index and S&P Small-Cap 600 Index appear even more reasonable relative to historical norms. At year-end, the S&P 400 had a forward P/E of 19.0x, just above its 30-year average of 18.2x and below its pre-COVID multiple of 20.9x. Similarly, S&P 600 ended the year with a forward P/E of 20.1x, a little above the 30-year average of 19.5x but below its pre-COVID level of 22.5x.

Overall, forward P/E multiples across these segments don’t seem too unreasonable compared to historical standards. The outsized strength of mega-cap technology companies since COVID has skewed broader market metrics and obscured underlying trends. These companies have achieved extraordinary earnings growth, expanded their multiples, and now account for a significantly larger share of the market. Notably, Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA) are each larger than the entire S&P Mid-Cap 400 Index.

Disclaimer: Bloomberg Estimates Price/Earnings Ratio is calculated by dividing the price of the security by Best Earnings Per Share (EPS). This EPS metric is the average of sell-side adjusted earnings per share estimates. The data for the S&P 500 Equal Weight Index only goes back to February 2010.

DISCLOSURE

Innovative Portfolios, LLC (“IP”) is an SEC-registered investment advisor founded in 2015. Clients or prospective clients are directed to IP’s Form ADV Part 2A prior to deciding to participate in any portfolio or making any investment decision. The views and opinions in the preceding publications are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in any commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, and is not intended to predict or depict performance of any investment. Any specific recommendations or comparisons that are made as to particular securities or strategies are for illustrative purposes only and are not meant as investment advice for any viewer. The companies mentioned in the publications may be held by Sheaff Brock Investment Advisors, Innovative Portfolios, Innovative Portfolios’ ETFs or any other affiliates or related persons. Therefore, there is a conflict of interest that the advisors may have a vested interest in the Companies and the statements made about them. Past performance does not guarantee or indicate future results.