Is the Economy’s “Soft Landing” Finally Here?

Economic conditions and data points continue to evolve, sending mixed signals. While growth appears to be slowing, the Federal Reserve Bank of Atlanta’s GDPNow model is projecting Q3 GDP growth at a healthy 2.0% as of August 26, 2024. Unemployment has risen to 4.3%, the highest level since October 2021. Part of this increase, however, is attributed to a surge in immigration over the last few years and a rise in the labor force participation rate. According to the U.S. Bureau of Labor Statistics, the labor participation rate for prime-age workers (25-54 years) reached 84% in July 2024, the highest since March 2001. Meanwhile, inflation continues to decline, with a rate of 2.9% through July 2024. With inflation stabilizing and the labor market showing signs of weakness, the Federal Reserve appears ready to begin cutting interest rates in September.

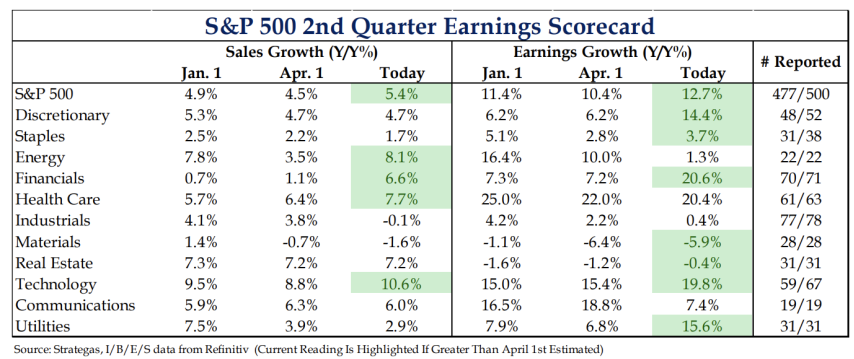

As of August 26, 477 of the 500 companies in the S&P 500 Index have reported Q2 earnings, with results generally surpassing expectations. Revenue growth for the quarter is now expected to be 5.4%, up from the initial expectations of 4.5% at the start of the quarter (April 1) and 4.9% at the beginning of the year. Four of the 11 sectors are tracking higher, two are in line with expectations, and the only notable decline is in the industrial sector. Earnings growth expectations have also risen to 12.7%, up from 10.4% at the start of the quarter. Currently, seven out of the 11 sectors have seen upward revisions, with notable misses in communications and energy.

Overall, both the economy and Wall Street seem to be progressing steadily. For many economists, the slowdown and recent data points align with predictions made in response to higher interest rates. Restrictive monetary policy has successfully reduced inflation without stifling growth. The Fed’s efforts to achieve a “soft landing” appear to be on track despite occasional turbulence, such as the surprise inflation readings in Q1 2024. The stock market also seems healthy, with broader participation beyond just the mega-cap technology names.

Strategas S&P 500 Earnings Scorecard as of 8/26/2024

DISCLOSURE

Innovative Portfolios, LLC (“IP”) is an SEC-registered investment advisor founded in 2015. Clients or prospective clients are directed to IP’s Form ADV Part 2A prior to deciding to participate in any portfolio or making any investment decision. The views and opinions in the preceding publications are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in any commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, and is not intended to predict or depict performance of any investment. Any specific recommendations or comparisons that are made as to particular securities or strategies are for illustrative purposes only and are not meant as investment advice for any viewer. The companies mentioned in the publications may be held by Sheaff Brock Investment Advisors, Innovative Portfolios, Innovative Portfolios’ ETFs or any other affiliates or related persons. Therefore, there is a conflict of interest that the advisors may have a vested interest in the Companies and the statements made about them. Past performance does not guarantee or indicate future results.